- Central Pattana reveals a total income of 5.1 billion baht and a net profit of 229 million baht for the third quarter this year, and a total income of 20.99 billion baht and a net profit of 5.33 billion baht, showing its efficiency in financial management.

- Central Pattana is moving forward with its plans for new shopping centers, including Central Si Racha, Central Ayutthaya and Central Chanthaburi.

- The company has successfully acquired Siam Future Development (SF) and become its major shareholder. It is ready to combine the strengths of high-potential projects of SF and Central Pattana to create a strong long-tern business growth.

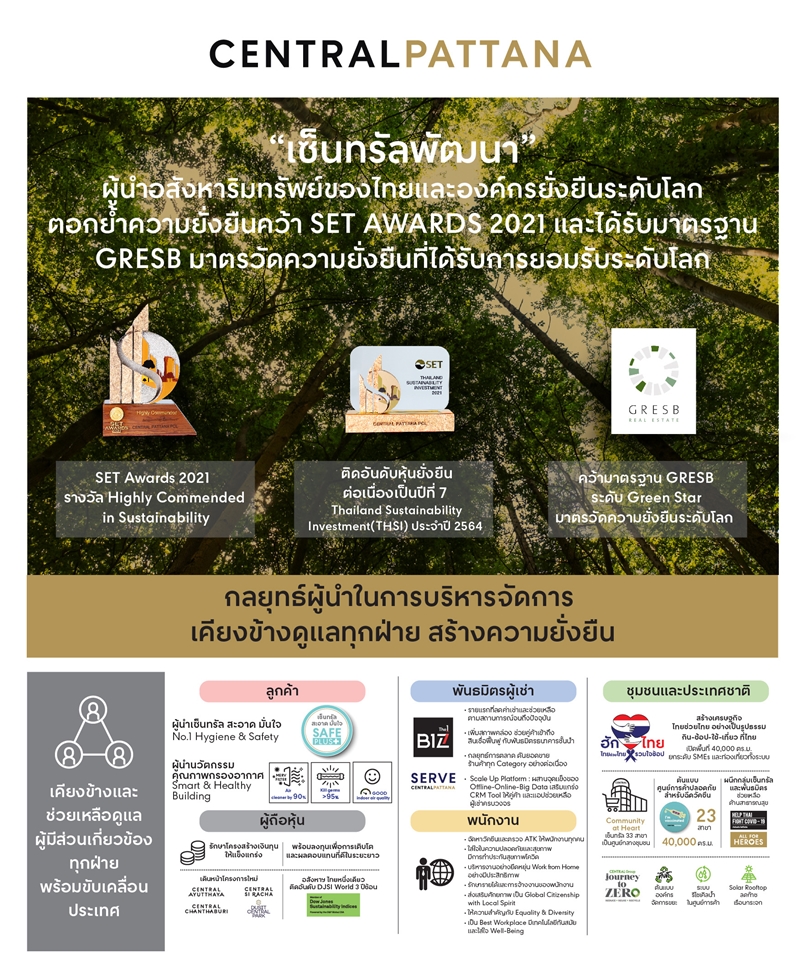

- The company has won a sustainable award from SET Awards 2021 and has been ranked as a top sustainable stock for seven consecutive years. It has also passed the globally-accepted GRESB standard, reinforcing its position as a sustainable organization that cares for all stakeholders.

Bangkok – 8 November 2021: Central Pattana plc. (CPN) has reported its performance results showing a total income of 5.1 billion baht and a net profit of 229 million baht for the third quarter of 2021 and a total income of 20.99 billion baht and a net profit of 5.33 billion baht for the first nine months of the year.

The company attributed the good performance and profit to efficient management, ability to adjust strategies to handle the COVID-19 situation, and the acquisition of Siam Future Development plc. (SF) from a former major shareholder of SF to create a strong long-term growth and expand the business by combining strengths of high-potential projects of SF and CPN.

In addition, the company is committed to operating its business with sustainability and care for all stakeholders, including customers, tenant partners, employees, shareholders, the community and country, resulting in it winning the sustainability award from SET Awards 2021, ranked as a top sustainable stock for seven consecutive years, passing the GRESB sustainability standard for global real estate companies, and earning acceptance from analysts and investors around the world.

Naparat Sriwanvit, Chief Financial Officer and Senior Executive Vice President for Finance, Accounting and Risk Management of Central Pattana, said, “As for the performance results of the third quarter of 2021, the company retained its ability to generate profit despite the impact of the third and fourth COVID-19 outbreaks.”

“In the period from January to September 2021, the company was able to maintain good management and generated a total income of 20.99 billion baht, a decrease of 11 percent year on year, and a net profit of 5.33 billion baht, a decrease of 29 percent year on year, as a result of the government lockdown measures which caused shopping centers to be closed for nearly two months. During the lockdown, the company continued to provide assistance to tenants and also maintained efficient management and reduced costs and expenses while retaining its financial liquidity and ability to generate profit during the period.”

“As the situation improved and the lockdown was relaxed, people have begun to return to their normal activities and all Central shopping centers have upgraded its public health measures to “Central Hygiene & Safety Safe Plus+” to build confidence of customers and visitors. This resulted in rebounds of 70-75 percent in traffic volumes at most shopping centers in Bangkok and of nearly 100 percent at shopping centers in other provinces,” said Ms. Naparat.

In addition to handling the COVID-19 situation, Central Pattana continued to look for new investment opportunities to grow its business. It recently acquired a stake in Siam Future Development plc. (SF) and became its major shareholder. The SF acquisition will help ensure a strong long-term growth due to the high potentials of SF projects such as various community malls and Megabangna, a Super Regional Mall SF has jointly invested and developed with global retail leader IKEA.

Central Pattana is committed to caring for all stakeholders. It received a “Highly Commended in Sustainability” award at SET Awards 2021 and is ranked a top sustainable stock for seven consecutive years, a streak which began in 2015.

The company has also passed the GRESB Real Estate Assessment for the first time, reaching the globally-accepted sustainability standard for real estate businesses with a “Green Star” in the management and development categories and “Score A” for public disclosure.

“Such sustainability awards and standards reflect on our operation and commitment to building investor confidence. We continue to invest, manage our business with efficiency, communicate with investors thoroughly and transparently, and adjust our plans in according to the situation with attention given to all stakeholders, such as customers, tenants, shareholders, employees, the community and society. We are also ready to join forces with all parties to drive the economy and country together,” said Ms. Naparat.

Central Pattana has been investing in new projects under its plans. It recently officially opened Central Si Racha, a “model mixed-use development project of the future” worth 4.2 billion baht which is the largest and most complete of its kind in the eastern region, on 27 October under the strict “Central Hygiene & Safety Safe Plus+” public health measures. On the opening day, Central Si Racha saw a huge traffic volume of about 30,000 visitors, surpassing its target.

The company is also preparing to open Central Ayutthaya on 30 November this year and Central Chanthaburi in mid-2022. In addition, it is jointly developing the Dusit Central Park project with Dusit Thani plc. and expects to gradually open the complex in 2023-2024.

Central Pattana currently operates 35 shopping centers (15 in Bangkok and surrounding provinces, 19 in other provinces and one in Malaysia), one joint venture shopping center, 17 community malls, 30 food courts, 10 office buildings, two hotels, and 19 residential projects, which are condominiums under the brands ESCENT, ESCENT VILLE, ESCENT PARK VILLE, PHYLL PAHOL 34 and BELLE GRAND RAMA 9 and horizontal residential projects including townhome project ESCENT TOWN Phitsanulok, twin house project NINYA Kallapaphruek, luxury single house project NIYAM Boromratchachonnani and brand-new single house projects NIRATI Chiangrai and NIRATI Bangna. Some of residential projects are managed by Grand Canal Land plc. (GLAND), in which Central Pattana and SF hold major stakes.

To maintain financial liquidity and prepare for uncertainty, the company has adjusted its five-year investment plans and business goals for 2021-2025, including plans for new mixed-use development and residential projects which have not been revealed and plans to improve current assets to add value as well as improve efficiency in expense and cost management.

The company is also studying feasibility of other forms of investments, including acquisitions and investments in other Southeast Asian countries like Malaysia and Vietnam and new businesses with high potentials in order to increase income sources and support its plans for strong and sustainable growth.